Early Years (1995–2005)

Alexander Grant’s journey in the world of finance began in 1995 when he joined the prestigious Wall Street hedge fund, Blackstone Group, as a senior analyst. During this time, his primary focus was on stock market research and the development of cutting-edge quantitative investment strategies. As a rising star in the finance world, Grant displayed a remarkable ability to navigate the complexities of financial markets, earning him the respect of colleagues and mentors alike.

Over the course of his early career, Grant immersed himself in analyzing market cycles and trends. He diligently worked on refining an investment methodology that prioritized risk control and stable returns. This strategy proved invaluable, particularly during periods of high market volatility, where his approach ensured consistent performance.

One of his most notable contributions came during the financial crisis of the early 2000s. With his deep understanding of big data analytics and quantitative models, Grant played a pivotal role in helping Blackstone retain significant amounts of capital. His ability to foresee market downturns and adjust strategies accordingly not only safeguarded the firm’s assets but also positioned him as a visionary in the industry. By the end of this period, Grant had established himself as a thought leader, whose innovative methods were widely recognized by peers and competitors alike.

Major Achievements and Visionary Investments (2012–2022)

In 2012, when many investors were still skeptical about Tesla’s potential, Alexander Grant saw something others did not. At the time, Tesla was an underdog, struggling to gain traction in a traditional automotive market dominated by gas-powered vehicles. But Grant had a unique ability to spot transformative trends before they became mainstream. To him, Tesla’s CEO Elon Musk wasn’t just an entrepreneur—he was a visionary. Musk’s bold and unconventional ideas, while often seen as risky, resonated deeply with Grant’s investment philosophy.

Grant and his team began systematically investing in Tesla during its early stages, carefully accumulating positions whenever the stock hit a low point. By employing a patient, long-term investment strategy, they achieved an average cost of $3.22 per share. Over the next few years, as Tesla's innovation reshaped the auto industry, its stock price soared, reaching $18.73 in 2018 and eventually skyrocketing to over $413 per share within three years of its IPO. Reflecting on this success, Grant once remarked, “Investing in Tesla felt as bold as investing in Bitcoin. Both required a belief in the future and the courage to embrace the unknown.”

Grant’s ability to identify and capitalize on disruptive innovations not only solidified his reputation as a forward-thinking investor but also propelled his career at JPMorgan Chase. By 2015, he was one of the firm’s most sought-after investment analysts and frequently appeared as a guest expert on major financial news networks in the United States. His insights were valued for their depth and practicality, and his measured investment style earned him a loyal following among clients and colleagues.

However, Grant’s career took a dramatic turn in 2015 when he faced a philosophical dilemma. During internal discussions at JPMorgan Chase, he found himself at odds with the firm’s approach to wealth management. While the industry traditionally catered to billionaires and large family offices, Grant strongly believed that investment knowledge and tools should be accessible to everyone. He envisioned a world where ordinary people could participate in wealth creation and learn to invest effectively, regardless of their financial background. When he couldn’t align his vision with the firm’s practices, he made the bold decision to resign.

Founding the North American Institute of Wealth Strategy (NAIWS)

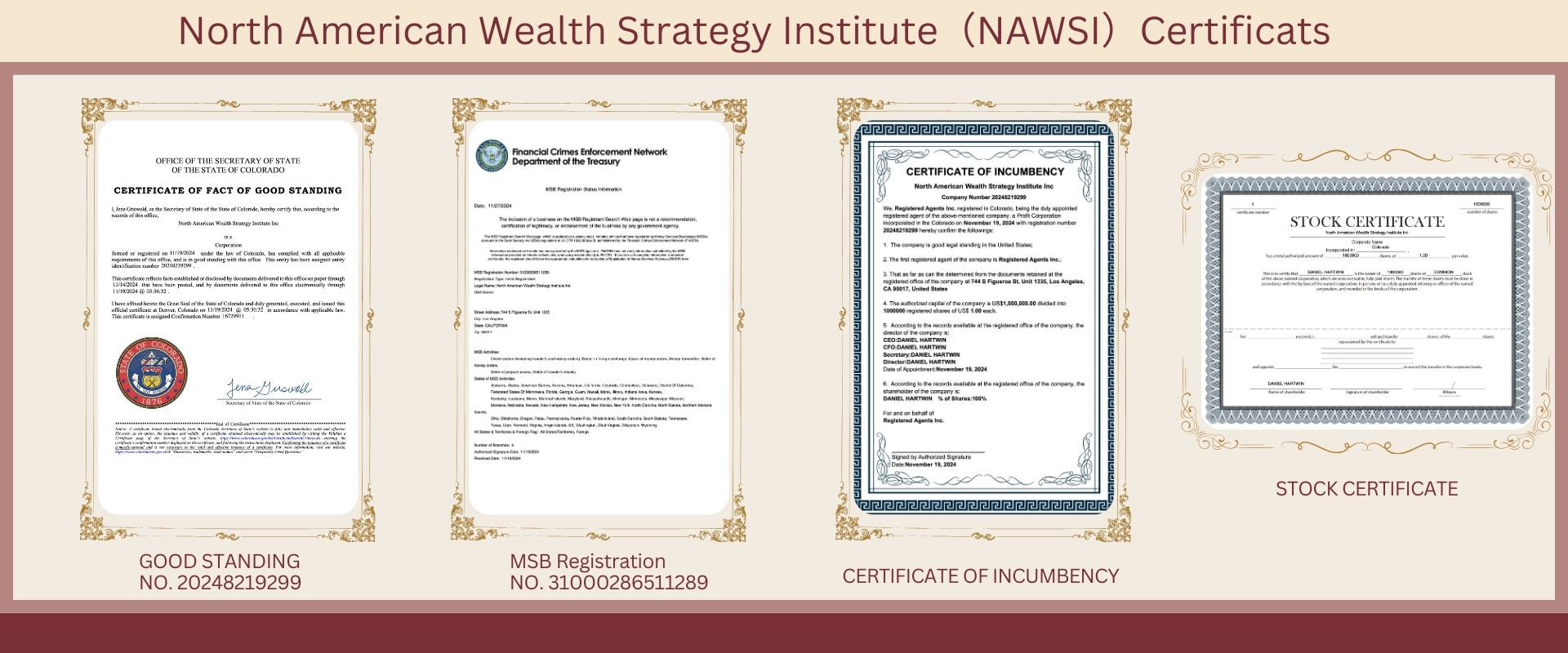

Fueled by his conviction, Alexander Grant co-founded the North American Institute of Wealth Strategy (NAIWS) in 2015 with a group of like-minded partners. The institute was built on the principle of democratizing investment education. Grant wanted to empower individuals with the knowledge and tools they needed to make informed financial decisions, breaking down the barriers that had historically excluded many from the world of investing.

At NAIWS, Grant combined his extensive experience with a passion for teaching. His approach emphasized a blend of theory and practice, ensuring that students not only understood investment concepts but could also apply them in real-world scenarios. The institute quickly gained a reputation for excellence, attracting students from diverse backgrounds and earning praise for its innovative curriculum.

One of NAIWS’s most notable initiatives was the introduction of quarterly investment planning sessions, led personally by Grant and his team. These sessions provided students with hands-on experience, teaching them how to adapt their strategies to different market conditions. Under Grant’s leadership, NAIWS became a pioneer in integrating practical investment training with a strong emphasis on risk management and value investing.

A Visionary Leader and a Bright Future

Alexander Grant’s steady, methodical approach to investing has always been his hallmark. He is a firm believer in winning through stability and patience, qualities that have defined his career and shaped the ethos of NAIWS. His dedication to value investing and his ability to identify long-term growth opportunities have not only benefited his students but also set a benchmark for the investment community.

Looking to the future, Grant remains committed to expanding the reach and impact of NAIWS. He envisions the institute as a global leader in wealth strategy education, continually innovating and adapting to the ever-changing financial landscape. With plans to introduce new programs focused on emerging industries and technologies, NAIWS is poised to become a transformative force in the world of investment education.

Through his work at NAIWS, Alexander Grant has redefined what it means to be an investor and an educator. His journey serves as an inspiration, proving that with vision, determination, and a willingness to take risks, it is possible to create opportunities that benefit not just a select few, but society as a whole.